what is a deferred tax provision

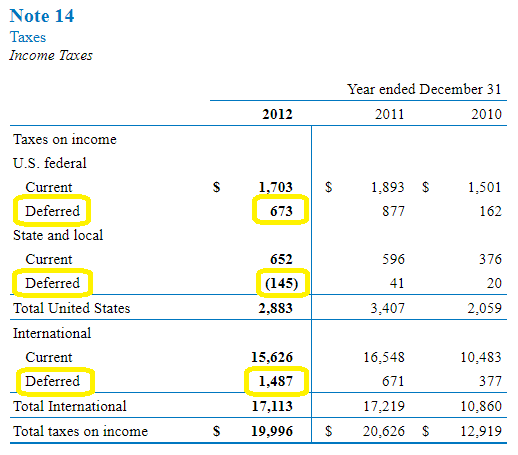

More specifically we focus on how government support in the form of tax incentives and tax relief might change previous assessments that were made applying IAS 12 Income Taxes IAS 12. Current tax expensebenefit Deferred tax expensebenefit Total income tax expense or benefit as reported in.

Deferred Tax Liabilities Meaning Example Causes And More

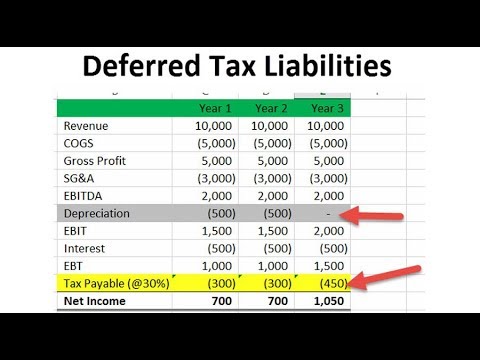

In year 1 they buy a computer for 1800 and this is written off in the accounts by way of a.

. There are 2 types of timing differences viz. An increase in deferred tax liability or a decrease in deferred tax assets is a source of cash. The result is your companys current year tax expense for the income tax provision.

Deferred income tax expense. Analyzing the change in deferred tax balances should also help to understand the future trend these balances are moving towards. In the above two examples ie deferred tax assets are arising due to depreciation and carry forward losses Carry Forward Losses Tax Loss Carry forward is a provision which permits an individual to take forward or carry over the tax loss to the next year to set off the future profit.

Generally FRS 102 adopts a timing difference approach ie deferred tax is recognised when items of income and expenditure are. Deferred tax is a topic that is consistently tested in Financial Reporting FR and is often tested in further detail in Strategic Business Reporting SBR. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts.

A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions Accounting Provisions The provision in accounting refers to an amount or obligation set aside by the business for present and future commitments. A few weeks ago you were introduced to the overall income tax provision in this blog post.

The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet. Answer 1 of 2. A business has profits each year of 5000 before any depreciation charge.

The deferred tax may be a liability or assets as the case may be. Now see that if deferred tax is not recognized provision for taxation isfluctuating significantly each year and so is the profit after tax figure despite same profit before tax in each year. Deferred tax liability is created when the Company underpays the tax which it will have to pay in the near future.

Deferred tax is the tax effect of timing differences. Deferred tax is the tax that is levied on a company that has either been deducted in advance or is eligible to be carried over to the succeeding financial years. The liability is deferred due to a.

Know more about its types calculation and scenarios in which it is recorded. This article will start by considering aspects of deferred tax that are relevant to FR before moving on to the more complicated situations that may be tested in SBR. The fluctuation is only due to temporary timing.

This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19. In that post we recalled the basic formula determining the income tax provision. A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in the future.

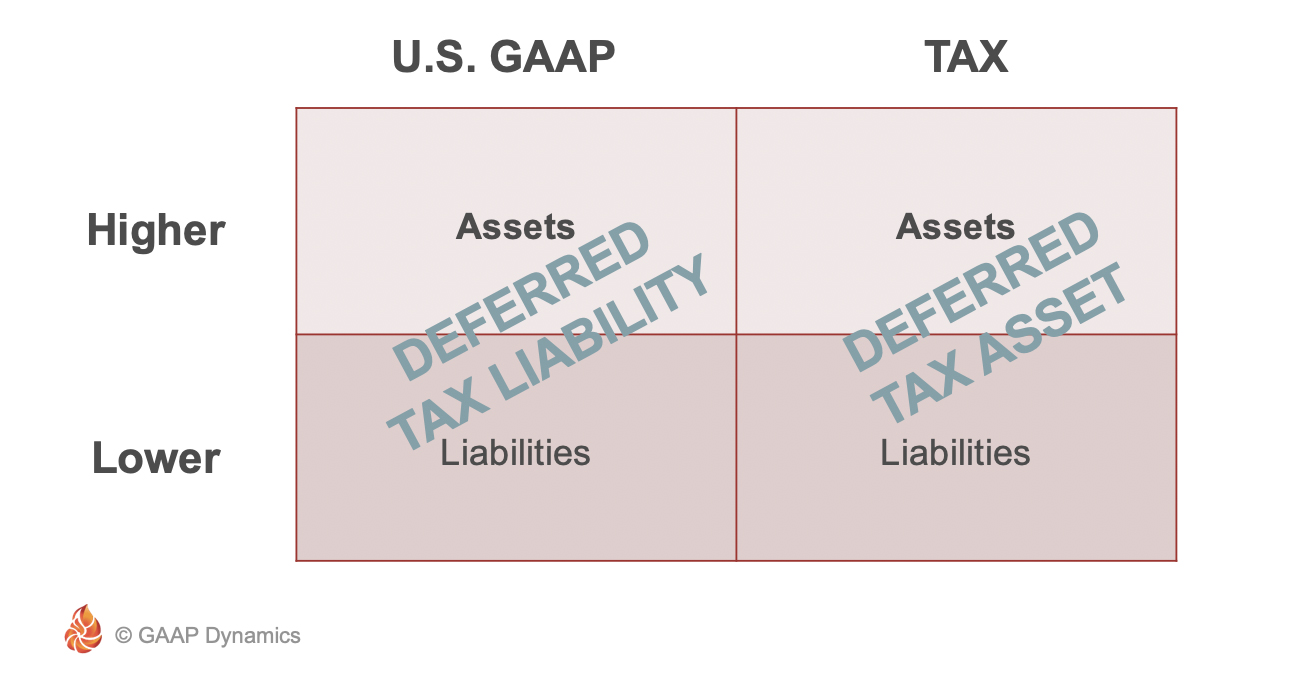

A deferred tax liability is a listing on a companys balance sheet that records taxes that are owed but are not due to be paid until a future date. While Permanent differences are the ones between taxable income and accounting income for a period. Deferred tax liabilities and deferred tax assets.

Deferred tax is the tax effect that occurs due to the temporary differences either taxable temporary difference or deductible temporary difference. As per AS 22 Current tax is the amount of income tax determined to be payable recoverable in respect of the taxable income tax loss for a period. Lets look at an example.

Hi Deferred Tax refer to tax effect in your Balance sheet due to timing differences in recognizing income. Note that there can be one without the other - a company can have only deferred tax liability or deferred tax assets. Deferred tax liability is calculated by finding the difference between the companys taxable income and its account earnings before taxes then.

Deferred tax can fall into one of two categories. The company usually either has deferred tax liability or deferred tax asset as the deferred tax would be net off between deferred tax liability and deferred asset. Example 1deferred tax asset related to a provision Applying IAS 37 Provisions Contingent Liabilities and Contingent Assets a company recognises a provision of CU100 regarding a legal dispute2 The company receives a deduction for tax purposes only.

Likewise a decrease in liability or an increase in deferred asset is a use of cash. Both will appear as entries on a balance sheet and represent the negative and positive amounts of tax owed. If deferred tax provision in not recognized then Profit and loss Account would look like as follows.

Accounting for Income Taxes under ASC 740. Deferred tax charge is not a provision for tax but is a provision for tax effect for difference between taxable income and accounting income and further that deferred tax charge cannot be termed as income-tax paid or payable which has to be paid out of the profit earned. This more complicated part of the income tax provision calculates a cumulative total of the temporary differences.

Define Deferred Tax Liability Or Asset Accounting Clarified

Deferred Income Tax Liabilities Explained With Real Life Example In A 10 K

Deferred Tax Double Entry Bookkeeping

Deferred Tax Liabilities Meaning Example How To Calculate

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Computation Of Deferred Tax Liabilities

Deferred Tax Asset Journal Entry How To Recognize

Deferred Tax Liabilities India Dictionary

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Liabilities Meaning Example How To Calculate

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Asset Journal Entry How To Recognize

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Net Operating Losses Deferred Tax Assets Tutorial

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)